- 11 minutes ago

- From the section Business

Image copyright European Photopress Agency

Image copyright European Photopress Agency

Wall Street shares eased back from earlier losses on a day of turmoil on global markets when the plunging oil price again panicked investors.

The Dow Jones and S&P 500 indexes closed 1.56% and 1.2% down, still big falls but a partial relief after tumbling more than 3% earlier.Europe's main markets fell sharply, led by the FTSE 100, which sank 3.46%.

Many markets are now in so-called bear market territory - a fall of 20% or more from their most recent peak.

At one point, the benchmark Brent oil index was down more than 5%, while US oil fell almost 7%, fuelling fears about the impact on economic growth and falling revenues earned by oil-rich nations.

Germany's Dax and the Cac 40 in Paris ended 2.82% and 3.45% down respectively. The FTSE 100's fall marked a 203.2-point fall, to 5,673.58

Since the FTSE 100's all-time high of 7,103.98 points on 27 April last year, the total market capitalisation of the index has fallen by £396bn.

The falls in Europe and the US came after Asian stocks closed sharply lower.

Markets in Dubai closed at a 28-month low, while in Japan shares fell to their lowest level since October 2014.

Top emerging market shares and currencies were also caught up in the turmoil, with the Russian rouble hitting a new record low of 80.295 against the dollar.

Analysis: Andrew Walker, economics correspondent:

Some observers think that many markets were riding for a fall. Asset prices were pumped up by ultra-low interest rates in the developed world and also by the central banks that have engaged in quantitative easing, buying financial assets with newly created money.That happened with shares, with bonds and with commodities. For commodities the boom is well and truly over, partly due to the slowdown in China and in the case of oil mainly due to plentiful supplies.

Clearly there are some troublesome developments and the IMF has a warning: "If these key challenges are not successfully managed, global growth could be derailed."

That at bottom is what the markets are worried about.

Read more from Andrew here

BP boss sees rising oil price

Just how low can oil prices go?

Why is the pound falling so sharply?

"Investors have decided the world is a riskier place," said Laura Lambie, senior investment director at Investec Wealth Investment.

She says that concerns over growth in China, the prospect of rising US interest rates and the possibility that low oil prices might force some oil companies out of business are the main concerns for investors.

"There's been a short-term change in sentiment," she said.

Oil slide continues

Meanwhile, US crude plunged to its lowest since May 2003, sinking 6.6% to $26.59, but later edging back to about 4% lower.

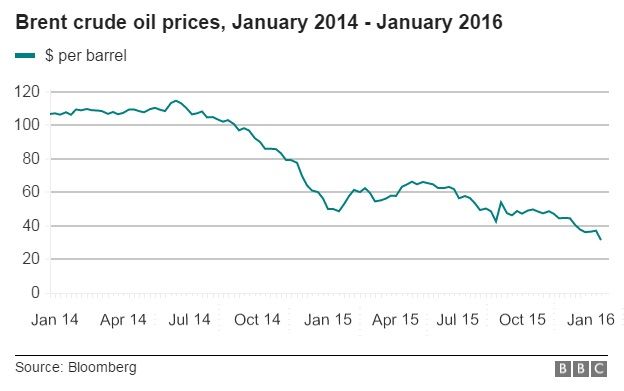

The oil price has plummeted 75% since mid-2014 as oversupply, mainly due to US shale oil flooding the market, has driven down the cost of the commodity.

At the same time, demand has fallen because of a slowdown in economic growth in China and Europe.

The world's energy watchdog warned on Tuesday that the market could "drown in oversupply".

The International Energy Agency, which advises countries on energy policy, said it expected the global glut to last until at least late 2016.

The International Monetary Fund's decision on Tuesday to downgrade its global growth forecast for this year and issue a warning about the outlook added to the dark mood among investors.

World stocks are now at their lowest levels since 2013, with the MSCI world equity index down 9.9% in January, its biggest drop since 2009.

Analysts said they expected the volatility to continue.

"I am quite pessimistic about the equity markets for the next two to three months. I do not see a 2008-style scenario, but I do see a bear market coming," said Andreas Clenow, hedge fund trader and principal at ACIES Asset Management.

No comments:

Post a Comment