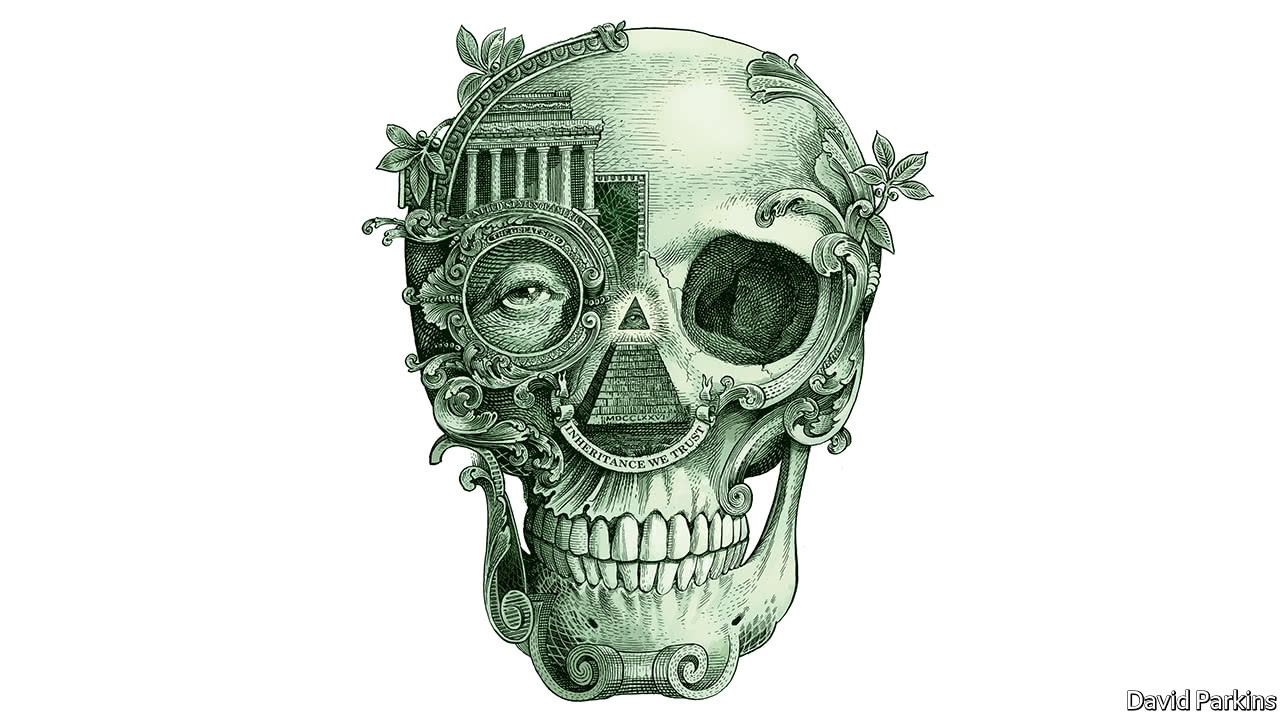

A hated tax but a fair one

The case for taxing inherited assets is strong

NO TAX is popular. But one attracts particular venom. Inheritance tax is routinely seen as the least fair by Britons and Americans. This hostility spans income brackets. Indeed, surveys suggest that opposition to inheritance and estate taxes (one levied on heirs and the other on legacies) is even stronger among the poor than the rich.

Politicians know a vote-winner when they see one. The estate of a dead adult American is 95% less likely to face tax now than in the 1960s. And Republicans want to go all the way: the House of Representatives has passed a tax-reform plan that would completely abolish “death taxes” by 2025. For a time before the second world war, Britons were more likely to pay death duties than income tax; today less than 5% of estates catch the taxman’s eye. It is not just Anglo-Saxons. Revenue from these taxes in OECD countries, as a share of total government revenue, has fallen sharply since the 1960s (see article). Many other countries have gone down the same path. In 2004 even the egalitarian Swedes decided that their inheritance tax should be abolished.

Yet this trend towards trifling or zero estate taxes ought to give pause. Such levies pit two vital liberal principles against each other. One is that governments should leave people to dispose of their wealth as they see fit. The other is that a permanent, hereditary elite makes a society unhealthy and unfair. How to choose between them?

That does not ring true. The logic would be to abrogate even the most modest of wills. But inheritances are deeply personal and the biggest single gift that many give to causes they believe in and loved ones they may have cherished. Many (living) people would feel wronged if they could not provide for their children. If anything, as the expression of their last wishes, bequests carry more weight than their passing fancies do.

The positive argument for steep inheritance taxes is that they promote fairness and equality. Heirs have rarely done anything to deserve the money that comes their way. Liberals, from John Stuart Mill to Theodore Roosevelt, thought that needed correcting. Roosevelt, who warned that letting huge fortunes pass across generations was “of great and genuine detriment to the community at large”, would doubtless be aghast at the situation today. Annual flows of inheritance in France have tripled as a proportion of GDP since the 1950s. Half of Europe’s billionaires have inherited their wealth, and their number seems to be rising.

However, in 2017, it is not clear exactly how decisive a role inheritance plays in the entrenchment of the hereditary elite. Data from Britain suggest that people tend not to lose their parents before they reach the age of 50. In rich countries the advantages that wealthy parents pass to their offspring begin with the sorting mechanism of marriage, in which elites increasingly pair up with elites (see article). They continue with the benefits of education, social capital and lavish gifts, not in the deeds to the ancestral pile.

Even if the link between inheritance-tax rates and inequality were clear, wealth can pay for a good tax lawyer. In the century since Roosevelt, Sweden and other high-taxers discovered that if governments impose a steep enough duty, the rich will find ways to avoid it. The trusts they create as a result can last even longer than the three generations it takes for family fortunes to go from clogs to clogs.

Armed with such arguments, some leap to the other extreme, proposing, as the American tax reform does, that there should be no inheritance tax at all. Not only is it right to let people hand their private property to their children, they say, but also bequests are often the fruits of labour that has already been taxed. And a large inheritance-tax bill is destructive, because it can cause the dismemberment of family firms and farms, and force the sale of ancestral homes.

Yet every tax is an intrusion by the state. If avoiding double taxation were a requirement of good policy, then governments would need to abolish sales taxes, which are paid out of taxed income. The risks that heirs will be forced to sell homes and firms can be mitigated by allowing them to pay the duties gradually, from cashflow rather than by fire-sales.

In fact, people who are against tax in general ought to be less hostile to inheritance taxes than other sorts. However disliked they are, they are some of the least distorting. Unlike income taxes, they do not destroy the incentive to work—whereas research suggests that a single person who inherits an amount above $150,000 is four times more likely to leave the labour force than one who inherits less than $25,000. Unlike capital-gains taxes, heavier estate taxes do not seem to dissuade saving or investment. Unlike sales taxes, they are progressive. To the extent that a higher inheritance tax can fund cuts to all other taxes, the system can be more efficient.

A sensible discussion is hard when inheritance taxes prompt such a visceral reaction. But their erosion has attracted too little debate. A fair and efficient tax system would seek to include inheritance taxes, not eliminate them.

Politicians know a vote-winner when they see one. The estate of a dead adult American is 95% less likely to face tax now than in the 1960s. And Republicans want to go all the way: the House of Representatives has passed a tax-reform plan that would completely abolish “death taxes” by 2025. For a time before the second world war, Britons were more likely to pay death duties than income tax; today less than 5% of estates catch the taxman’s eye. It is not just Anglo-Saxons. Revenue from these taxes in OECD countries, as a share of total government revenue, has fallen sharply since the 1960s (see article). Many other countries have gone down the same path. In 2004 even the egalitarian Swedes decided that their inheritance tax should be abolished.

Latest updates

When the heirs loom

Some people argue for a punitive inheritance tax. They start with the negative argument that dead people no longer enjoy the general freedom to disburse their wealth as they wish—as the dead have no rights. How could they, when they are not affected one way or the other by what happens in the world?That does not ring true. The logic would be to abrogate even the most modest of wills. But inheritances are deeply personal and the biggest single gift that many give to causes they believe in and loved ones they may have cherished. Many (living) people would feel wronged if they could not provide for their children. If anything, as the expression of their last wishes, bequests carry more weight than their passing fancies do.

The positive argument for steep inheritance taxes is that they promote fairness and equality. Heirs have rarely done anything to deserve the money that comes their way. Liberals, from John Stuart Mill to Theodore Roosevelt, thought that needed correcting. Roosevelt, who warned that letting huge fortunes pass across generations was “of great and genuine detriment to the community at large”, would doubtless be aghast at the situation today. Annual flows of inheritance in France have tripled as a proportion of GDP since the 1950s. Half of Europe’s billionaires have inherited their wealth, and their number seems to be rising.

However, in 2017, it is not clear exactly how decisive a role inheritance plays in the entrenchment of the hereditary elite. Data from Britain suggest that people tend not to lose their parents before they reach the age of 50. In rich countries the advantages that wealthy parents pass to their offspring begin with the sorting mechanism of marriage, in which elites increasingly pair up with elites (see article). They continue with the benefits of education, social capital and lavish gifts, not in the deeds to the ancestral pile.

Even if the link between inheritance-tax rates and inequality were clear, wealth can pay for a good tax lawyer. In the century since Roosevelt, Sweden and other high-taxers discovered that if governments impose a steep enough duty, the rich will find ways to avoid it. The trusts they create as a result can last even longer than the three generations it takes for family fortunes to go from clogs to clogs.

Armed with such arguments, some leap to the other extreme, proposing, as the American tax reform does, that there should be no inheritance tax at all. Not only is it right to let people hand their private property to their children, they say, but also bequests are often the fruits of labour that has already been taxed. And a large inheritance-tax bill is destructive, because it can cause the dismemberment of family firms and farms, and force the sale of ancestral homes.

Yet every tax is an intrusion by the state. If avoiding double taxation were a requirement of good policy, then governments would need to abolish sales taxes, which are paid out of taxed income. The risks that heirs will be forced to sell homes and firms can be mitigated by allowing them to pay the duties gradually, from cashflow rather than by fire-sales.

In fact, people who are against tax in general ought to be less hostile to inheritance taxes than other sorts. However disliked they are, they are some of the least distorting. Unlike income taxes, they do not destroy the incentive to work—whereas research suggests that a single person who inherits an amount above $150,000 is four times more likely to leave the labour force than one who inherits less than $25,000. Unlike capital-gains taxes, heavier estate taxes do not seem to dissuade saving or investment. Unlike sales taxes, they are progressive. To the extent that a higher inheritance tax can fund cuts to all other taxes, the system can be more efficient.

Transfer market

The right approach is to strike a balance between the two extremes. The precise rate will vary from country to country. But three design principles stand out. First, target the wealthy; that means taxing inheritors rather than estates and setting a meaningful exemption threshold. Second, keep it simple. Close loopholes for those who are caught in the net by setting a flat rate and by giving people a lifetime allowance for bequests; set the rate high enough to raise significant sums, but not so high that it attracts massive avoidance. Third, with the fiscal headroom generated by higher inheritance tax, reduce other taxes, lightening the load for most people.A sensible discussion is hard when inheritance taxes prompt such a visceral reaction. But their erosion has attracted too little debate. A fair and efficient tax system would seek to include inheritance taxes, not eliminate them.

No comments:

Post a Comment