Murder most foul

When periods of economic growth come to an end, old age is rarely to blame

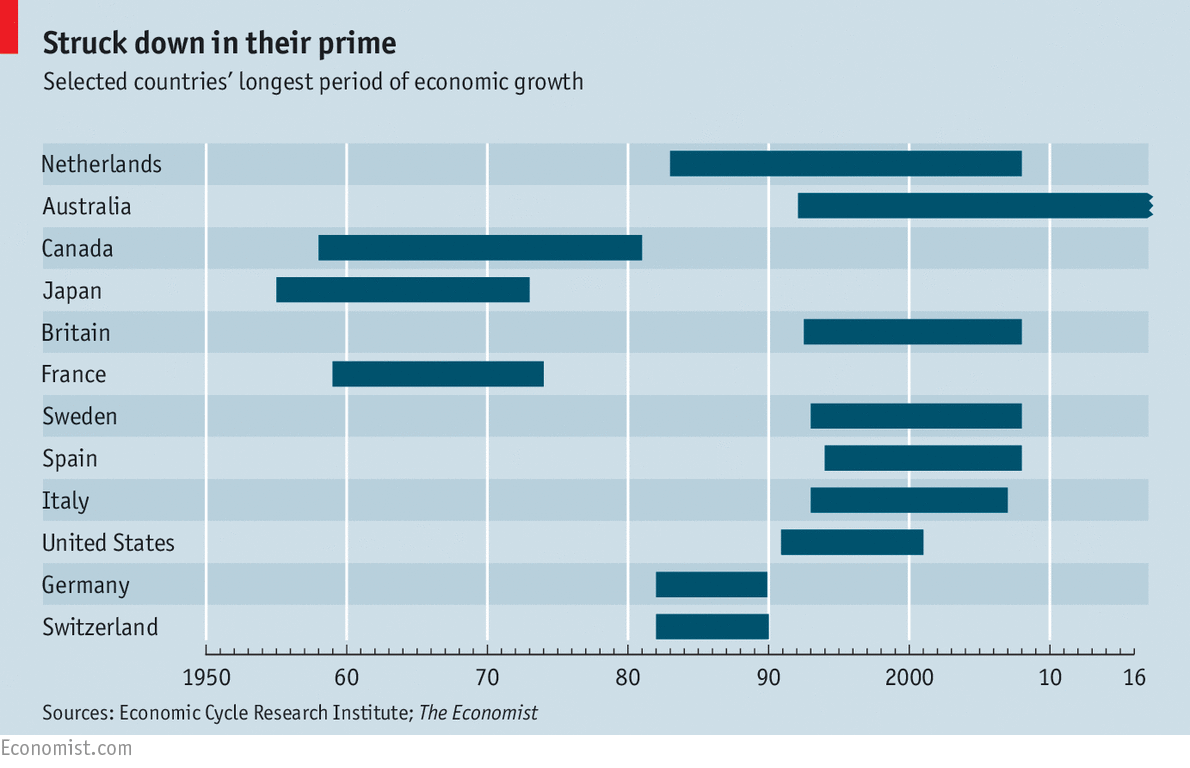

It is tempting to look at that ten-year mark as something like the maximum lifespan of an expansion in America, and to worry, correspondingly, that the current expansion’s days are running short. But are they? At a press conference in December Janet Yellen, chairman of America’s Federal Reserve, declared: “I think it’s a myth that expansions die of old age.” Yet die they do. Either Ms Yellen is wrong, or someone is bumping off otherwise healthy expansions before their time.

Like death, recessions (commonly defined as two consecutive quarters of falling GDP) are a part of life. Supply shocks occasionally prompt them: soaring oil prices in 1973 hit consumers in rich economies like an enormous tax rise, for instance, diminishing their purchasing power and thus prompting GDP to fall. More often, weak demand is to blame. Financial-market wobbles or rising interest rates cause people to cling tighter to their cash. Fear proves contagious, leading to a spiral of self-fulfilling pessimism.

Advertisement

|

Earlier this year Glenn Rudebusch of the Federal Reserve Bank of San Francisco constructed an actuarial table for America’s historical expansions, much as a life-insurance company would for people. In rich countries the probability of a person’s death rises gradually from middle age until the mid-80s, then quite steeply thereafter. Expansions, however, do not seem to become more vulnerable with age. There have been only 12 American expansions since the end of the second world war; the universe of people who have lived and died is somewhat larger. But the data available suggest that there was a time when cycles aged like people. Before the second world war, Mr Rudebusch notes, the odds of tipping into recession rose as an expansion got older. Yet since the 1940s age has not withered them: an expansion in its 40th month is just as vulnerable, statistically, as one in its 80th (each has about a 75% chance of surviving the next year).

The notion of ageless recoveries is counter-intuitive. Finite business cycles seem to make sense: an economy just coming out of recession should have plenty of opportunities for investment, for example, which, once exhausted, make the onset of a new downturn more likely. Yet economists reckon cycles need not unfold like that; instead, it is possible for the composition of growth to change even as expansion continues. A booming tech sector might siphon off capital that would otherwise flow to infrastructure or housing. Those industries, in turn, could power growth once the tech boom runs its course. If all domestic investment opportunities are used up, capital should flow towards foreign investments, reducing the value of the currency and so helping exporters to spur the economy forward. As long as the end of a boom in one sector does not engender self-fulfilling pessimism in the rest of economy, the show should go on.

Why, then, should an economy ever find itself in recession? In the pre-war era, when age mattered more, governments and central banks played a much smaller part in stabilising the economy. Economic shocks (from earthquakes to financial crises) come along every so often; the longer an expansion goes on, the greater the chance that a really nasty mishap will occur, pushing the economy into a downturn.

Yet after the Depression, governments took on the job of countering pessimism. Bigger welfare states provided bigger “automatic stabilisers”, meaning spending on things like unemployment benefits, which pump more money into an economy as growth weakens. Central banks began manipulating interest rates more vigorously to keep growth on track, and eventually adopted targets to help instil the expectation of steady growth.

Ms Yellen, in the ballroom, with the premature rate rise

Post-war expansions are longer (and recessions shorter) than was once

the case, but business-cycle immortality remains elusive. The end of

some expansions is clearly the result of foul play. In the early 1980s,

for instance, both America and Britain suffered recessions that were

deliberately induced in order to bring down raging inflation.In other cases the culprit is human error. As central bankers freely admit, their control over the economy is imperfect. Policy works on a delay. Since not every shock can be anticipated, a bad blow may start a recession before a central bank can adequately respond. Or an inflation-averse central bank may discover, after it is too late to adjust course, that it raised interest rates once too often. What’s more, with interest rates in many economies near zero, central bankers find themselves increasingly reliant on unconventional tools, for which the margin of error is larger.

But there is a difference between misfortune and recklessness. Central banks that worry more about high inflation than low will tend to err on the hawkish side, and will find themselves steering into recession with some regularity. The Reserve Bank of Australia, which targets an inflation rate of between 2% and 3%, has given itself a floor to defend as well as a ceiling. That seems to help it from sinking into recession by mistake. The Fed, which has begun raising interest rates even as its preferred inflation measure remains below its target, has not absorbed this lesson—and Ms Yellen’s comments about the natural life of expansions should not be considered an alibi.

No comments:

Post a Comment